SmallCap Investment Strategy: A Comprehensive Guide

Investing in small cap mutual funds can be a lucrative endeavor, offering substantial returns when approached with the right strategy. This article breaks down a small cap investing strategy that has delivered impressive above-benchmark returns in the long run.

Understanding the Basics

Large cap indices, particularly NIFTY 50, has provided a 10-year annualised return of 13.59%. On the other hand, small cap indices like the NIFTY Small Cap 250 have yielded a slightly higher annual return of 16.9%. These returns can be replicated by investing in low-cost index funds. However, by adjusting the magnitude and timing of investment in a NIFTY SmallCap 250 Index Fund, one can achieve above-benchmark returns, significantly higher than the NIFTY SmallCap 250 Index in the long run.

Step-by-Step Investment Strategy

1. Collecting Data

To begin, we gather the fortnightly closing values of the NIFTY 50 and NIFTY Small Cap 250 indices. This data is available on the NSE India website under the “Historical Index Data” section.

2. Evaluating Individual Index Performance

Using the XIRR formula, we calculate the annualized returns of fortnightly SIPs in the NIFTY 50 and the NIFTY Small Cap 250 Index funds for the time period we want to analyse. We will use these returns as benchmarks for our investment strategy.

3. Determining the Thresholds and Rules

To implement the strategy, we first calculate the ratio of NIFTY Small Cap 250 TRI returns to NIFTY 50 TRI returns and its standard deviations (σ). These standard deviations act as thresholds for the investment rules. We plot the timeseries of this ratio and its standard deviations on a chart.

We make use of this ratio value and the standard deviations to determine the magnitude of our fortnightly investment in the NIFTY SmallCap 250 Index fund as follows:

- If +1 σ ≤ Ratio < +2 σ, invest ₹X.

- If Ratio ≥ +2 σ, withdraw ₹X*6.

- If -1 σ ≤ Ratio < +1 σ, invest ₹X*3.

- If -2 σ < Ratio ≤ -1 σ, invest ₹X*5.

- If Ratio ≤ -2 σ, invest ₹X*6.

4. Explanation of Rules

Here is the logical explanation for the rules defined above:

- Moderate Investment (+1 σ to +2 σ): When the ratio is between +1 σ and +2 σ, we make moderate investments of ₹X. This ensures capital is invested when the small cap index is performing reasonably well but not excessively overvalued.

- Aggressive Withdrawal (≥ +2 σ): When the ratio exceeds +2 σ, the small cap index is significantly overvalued, thus we withraw ₹X*6. This helps lock in gains and reduces exposure to a potentially overheated market.

- Increased Investment (-1 σ to +1 σ): For ratios between -1 σ and +1 σ, we invest ₹X*3, as this indicates stable market conditions. This approach ensures continued investment in favorable conditions.

- High Investment (-2 σ to -1 σ): When the ratio falls between -2 σ and -1 σ, the small cap index is undervalued, hence we invest a higher amount of ₹X*5 to capitalize on lower valuations and maximize future returns.

- Maximum Investment (≤ -2 σ): If the ratio drops below -2 σ, indicating significant undervaluation, we invest ₹X*6. This aggressive investment captures the highest potential gains from a recovering market.

Conclusion

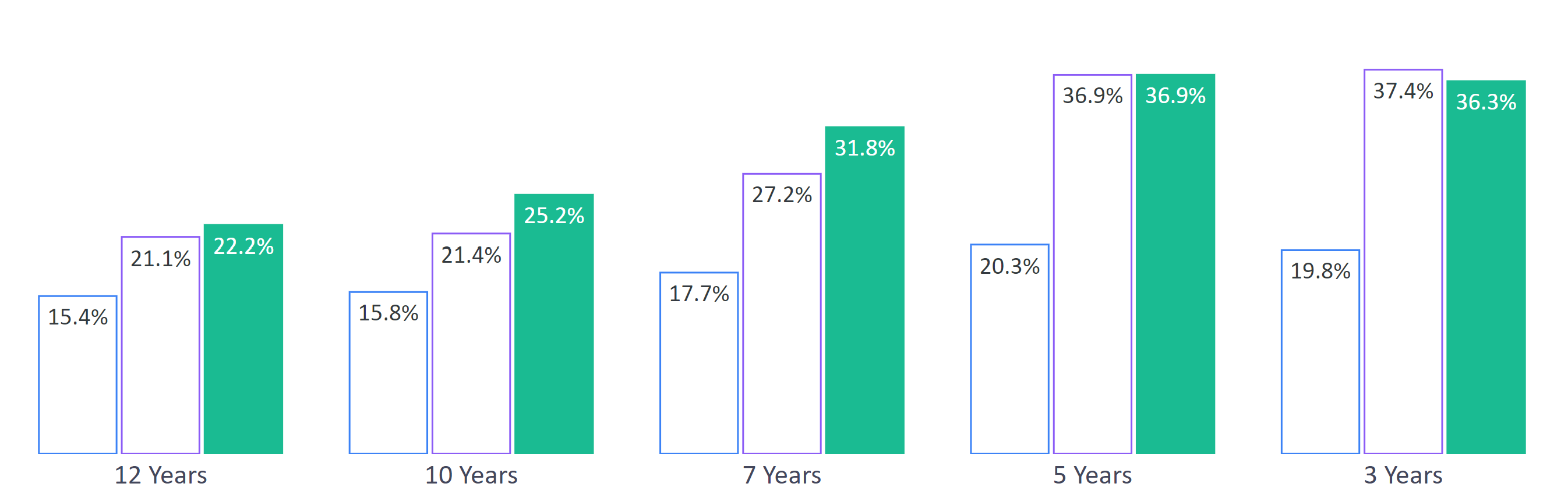

The chart compares the returns of this strategy against fortnightly Systematic Investment Plans (SIPs) of ₹X in NIFTY SmallCap 250 TRI and NIFTY 50 TRI. Above-benchmark returns are generated in the long term by using this strategy to adjust the timing and magnitude of investment / withdrawal from a NIFTY SmallCap 250 Index Fund. Specifically, the returns significantly exceed the benchmark over 7-year, 10-year, and 12-year periods. This can be attributed to the fact that the cycle of the relative [under/over]-performance of smallcaps over large caps plays out over a longer time period.

In summary, small cap investing, when approached tactically, can significantly outperform simple SIP investments in either large or small cap indices. By implementing a threshold-based strategy, investors can achieve a robust annualized returns over and above the benchmark in the long run.

If you found this strategy useful, share it with your friends and help them optimize their small cap investments. Thank you for your time, and happy investing!