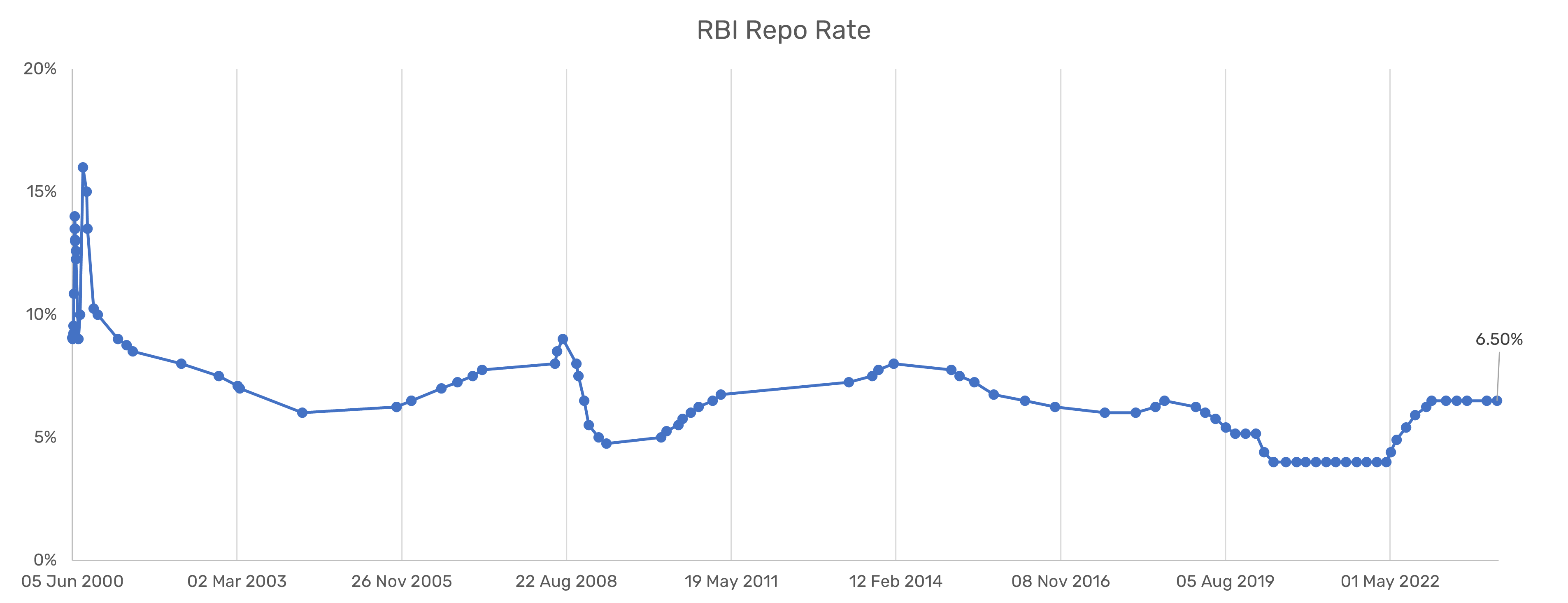

Fixed Income Investment Strategies for Rising and High Interest Rate Environments

Interest rates are one of the most important factors that affect the performance of fixed income instruments. Fixed income instruments are securities that usually pay a fixed amount of coupon (as a percentage of face value) over a specified period of time and also repay the face value on maturity. These include bonds, money market funds, treasury bills, etc. There are also zero-coupon fixed income instruments that don’t pay any coupon, but are traded at a deep discount to their face value.

When interest rates rise, the prices of existing fixed income instruments fall. This is because investors can get higher returns by investing in new securities that offer higher coupon. Conversely, when interest rates fall, the prices of existing fixed income instruments rise. This is because investors are willing to pay more for securities that offer higher coupon than the prevailing market rates.

Investors who hold fixed income instruments face two major risks: credit risk and interest rate risk. Credit risk is the risk of default or non-payment by the issuer of the security. Interest rate risk is the risk of losing money due to changes in interest rates.

In this article, we will discuss some strategies to invest in fixed income instruments in rising and high interest rate environments.

1. Shorten the Duration

One way to reduce your exposure to interest rate risk is to shorten the duration. Duration is a measure of how sensitive a fixed income instrument's price is to changes in interest rates. The longer the duration, the more sensitive the price is to changes in interest rates.

For example, if a bond has a modified duration of 4% and interest rate increase by 1 percentage point, then that bond’s price would be expected to decline by approximately 4%.

Therefore, if you expect interest rates to rise or if they are already high, you may want to invest in short duration fixed income instruments such as money market funds, short-term bonds, or certificates of deposit. These instruments have lower sensitivity to interest rate changes and will most likely have high yields if the interest rates have already increased significantly.

Common investors can implement this strategy by shifting to Low Duration, Money Market or Short Duration mutual funds. This is a good way to park money that you require within the next 1 or 2 years. Be sure to check the credit quality of the holdings in these schemes too as you do not want to take on unnecessary credit risk.

2. Gradually Shift Your Allocation Towards Securities with Longer Duration

This strategy may seem counter-intuitive at first glance but it can be beneficial if you have a long-term investment horizon and can tolerate some volatility.

The rationale behind this strategy is that securities with longer duration also tend to appreciate more when interest rates eventually fall after reaching their peak levels. Therefore, if you buy long duration bonds when their prices are low due to rising or already high interest rates, you can lock-in high yields for future cash flows and enjoy capital gains when their prices rebound due to falling interest rates.

However, this strategy requires patience and discipline as it involves buying low and selling high which can be difficult for many investors who tend to chase performance or panic sell.

Therefore, if you expect interest rates to rise temporarily or cyclically, you may want to gradually start investing in longer duration securities. Common investors can implement this by gradually building up positions in Medium and Long Duration mutual fund schemes. A gilt fund with long duration holdings would be ideal for this strategy as it would essentially eliminate credit risk while taking exposure to higher interest rate risk. However, their holdings are not guaranteed to be in long duration securities all the time, hence is it essential to check their modified durations on a fortnightly basis, if you chose to invest in one.

3. Diversify Across Sectors and Geographies

Another way to reduce your exposure to interest rate risk is to diversify across sectors and geographies. Different sectors and regions may have different economic conditions and monetary policies that affect their interest rates.

For example, suppose you invest only in US Treasury bonds. If the US Federal Reserve raises its policy rate to curb inflation, your portfolio will suffer losses due to rising interest rates. However, if you also invest in emerging market bonds or corporate bonds from other countries that have lower inflation and lower policy rates, your portfolio may benefit from lower or stable interest rates.

Therefore, if you expect interest rates to rise globally or regionally, you may want to diversify your portfolio across different sectors and geographies. These instruments may have different credit risks and currency risks but they may also offer higher returns and lower correlation with each other.

For common investors, this strategy is more cumbersome to implement as compared to the previous ones. The easiest way to invest in foreign treasuries and corporate bonds from India is through low-cost ETFs.